Hong Kong talents, don't divide dividends before reading this article!

After the 2023 policy report, Hong Kong Gaocai hesitated to add 3 mainland universities to Category B and attracted much attention. At present, as long as the undergraduate graduates of the 12 mainland universities listed below, they have the opportunity to be approved for Hong Kong identity.

Hong Kong talent Famous schools on the list

Tsinghua University

Peking University

Fudan University

Zhejiang University

Shanghai Jiaotong University

University of Science and Technology of China

Sun Yat-sen University

Nanjing University

Huazhong University of Science and Technology

Wuhan University

Newly added famous schools

Harbin University of Technology

Newly added famous schools

Xi'an Jiaotong University

Newly added famous schools

As for the applicants whose academic qualifications are at a disadvantage, there is also Hong Kong's talented A category, that is, the high salary category. This plan is not only suitable for a high-paid enterprise manager, but also for a self-employed business, a partnership partner, and a joint-stock shareholder. Today, what is the key point of the income documents for these three types of applications?

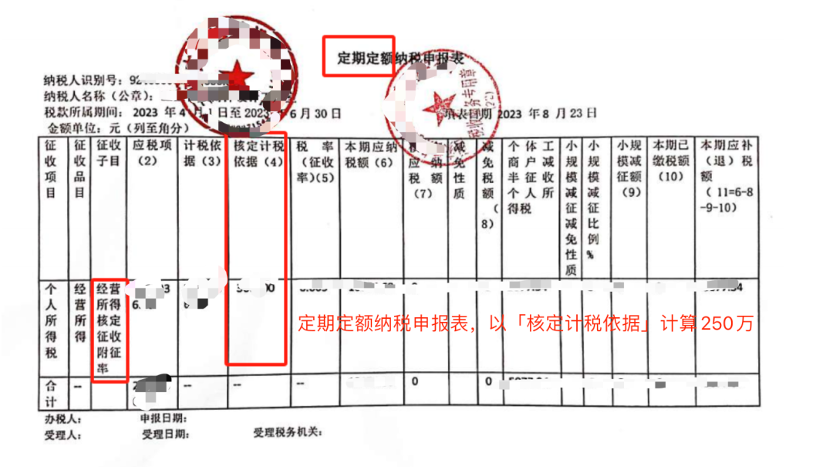

The first is the self-employed applicant. Yes, the self-employed can also apply for Hong Kong Gaocai. The key document in the application document is often the "regular fixed tax return", but please note that the data calculated here is the "approved tax basis" rather than "taxable items". In particular, if you don't meet the conditions for the time being, you must pay attention to this one if you want to maintain the conditions.

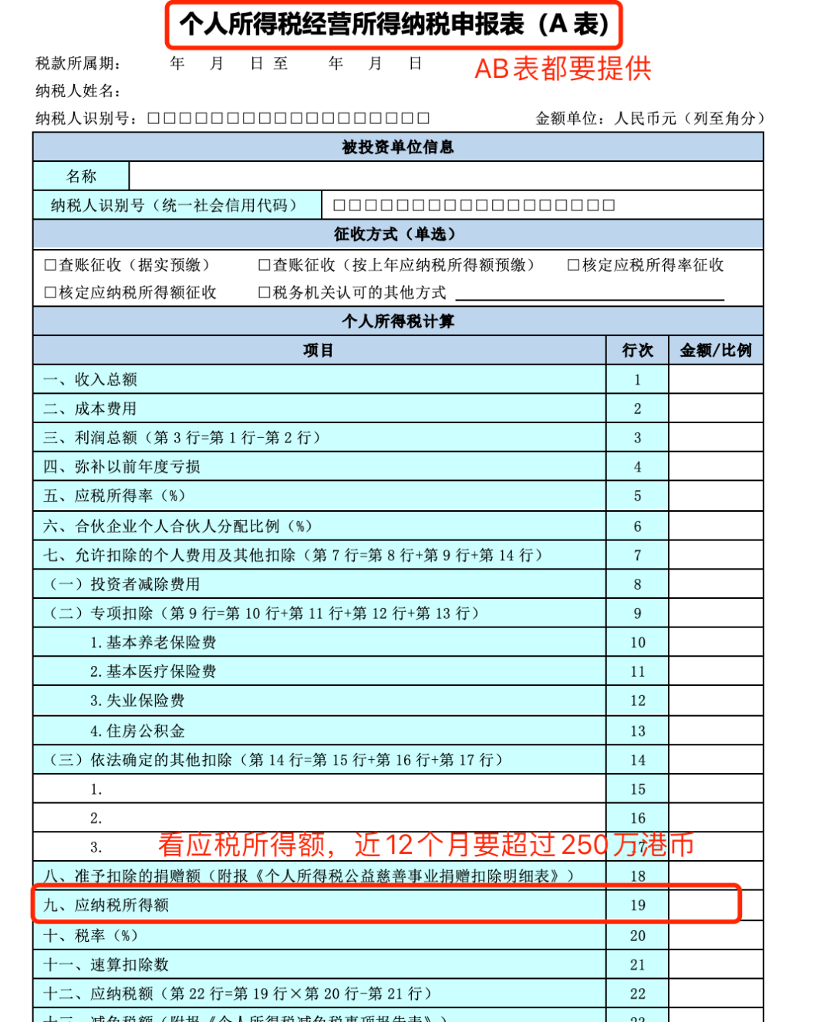

The other category is partnerships.

The key document provided by the general applicant is the “Monthly (quarterly) Declaration Form of Personal Income Tax on Operating Income”. It should be noted that not all total income can be calculated, and it still depends on the specific amount of taxable income.

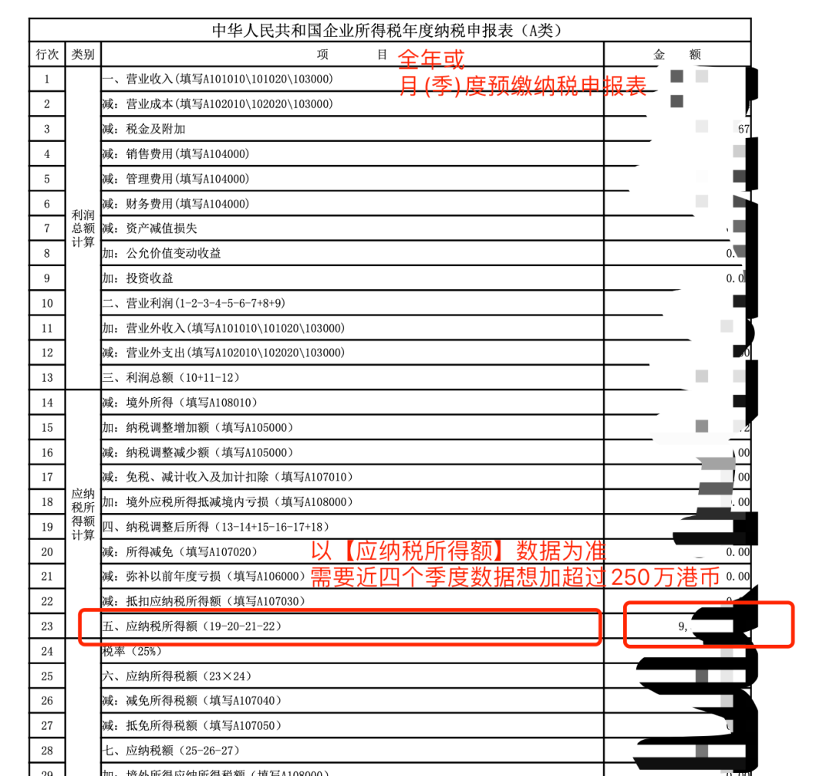

For the most common shareholder dividends, the recent review has indeed become stricter. In the past, dividends may only need to prove that the source is legal and the tax is paid, but at present, the immigration office may also trace the "rationality" of the dividend. What does this mean?

First of all, the applicant will be required to have a document on the relationship with this company, which needs to prove that the applicant is legal and reasonable to be able to obtain the approved benefit distribution from the enterprise. On the other hand, it is possible to further trace the source of dividends. The "Enterprise Income Tax Return" of the dividend-paying enterprise in the past four quarters will be required to calculate the profit of the enterprise in the past four quarters. The source of dividends needs to be earned in the past four quarters. If the remaining profit of previous years is distributed, it will be in accordance with the application. The qualification is doubtful, because the bill says that the applicant's income should reach 2.5 million Hong Kong dollars in the previous year. Once the dividend is paid, there will be a tax cost, so it is suggested that you can come to us for evaluation before dividend payment. However, a new problem arose. Is it necessary to pay dividends?

It is not necessary to pay dividends. If the profit of the enterprise in the past four quarters is sufficient, and the applicant holds a large proportion of the shares of the enterprise, the global professional copywriter will make a decision for you. If you are the absolute beneficiary of the enterprise, you can try to apply directly with the enterprise's tax payment without additional dividends and tax payment. Therefore, the case of entrepreneurs is relatively flexible and has room for operation. Welcome to consult us in advance.

Recently, the details of the contract renewal of Hong Kong Gaocai have also been released. 1. For employers in Hong Kong or companies established by yourself, you need to provide a document explaining the economic situation. For a new company established in the past 12 months, you need to provide a business plan 2. If the later stage does not involve changing employers or establishing a new company, the above-mentioned relevant documents of the company do not need to be provided again. Choosing a good intermediary is also choosing a 7-year-old companion.